This is posted to the Cash T-account on the debit side left side. To run successful operations a business needs to purchase raw material and manage its stock optimally throughout its operational cycle.

Recording Purchase Of Office Supplies On Account Journal Entry

In this case the company ABC can make the journal entry for the paid cash for supplies on March 18 2021 as below.

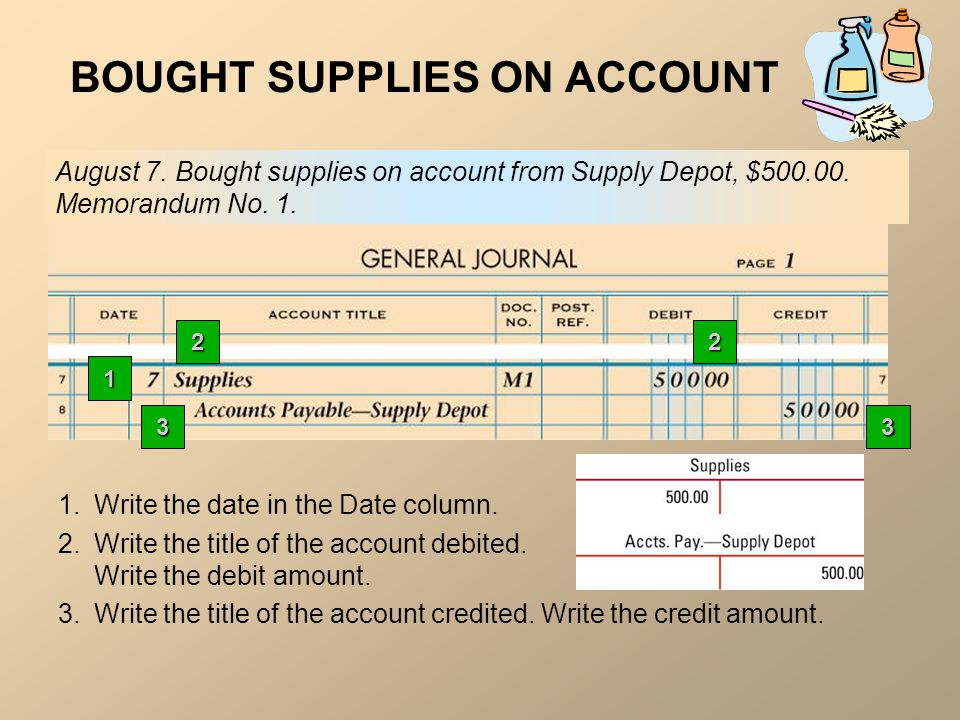

. 800 Accounts Payable Accounts Receivable OB. Double-entry bookkeeping in accounting is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different accountThis lesson will cover how to create journal entries from business transactions. The Green Company purchased office supplies costing 500 on 1 January 2016.

This entry is made as follows. Despite the temptation to record supplies as an asset it is generally much easier to record supplies as an expense as soon as they are purchased in order to avoid tracking the amount and cost of supplies on hand. 000 Accounts Payable Cash OC Cash Accounts.

The first entry debits the accounts receivable account and credits the purchase returns and allowances account. Paid Cash for Supplies Journal Entry Example. The following are the journal entries recorded earlier for Printing Plus.

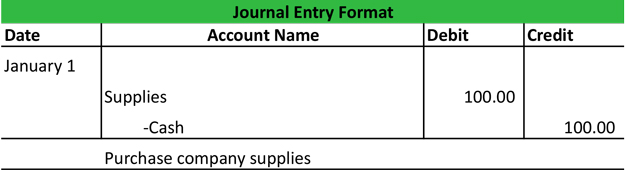

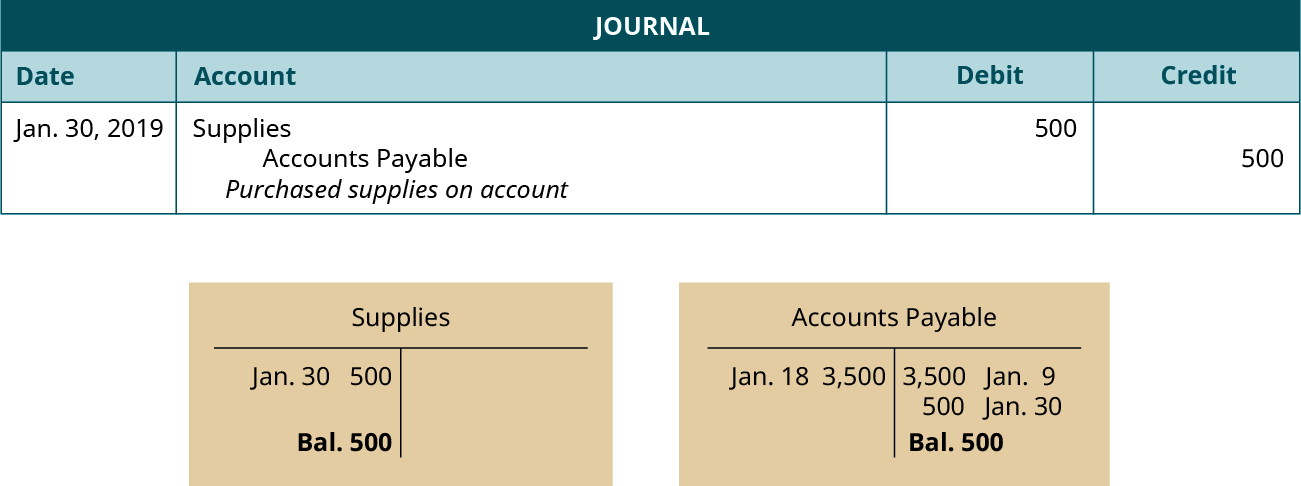

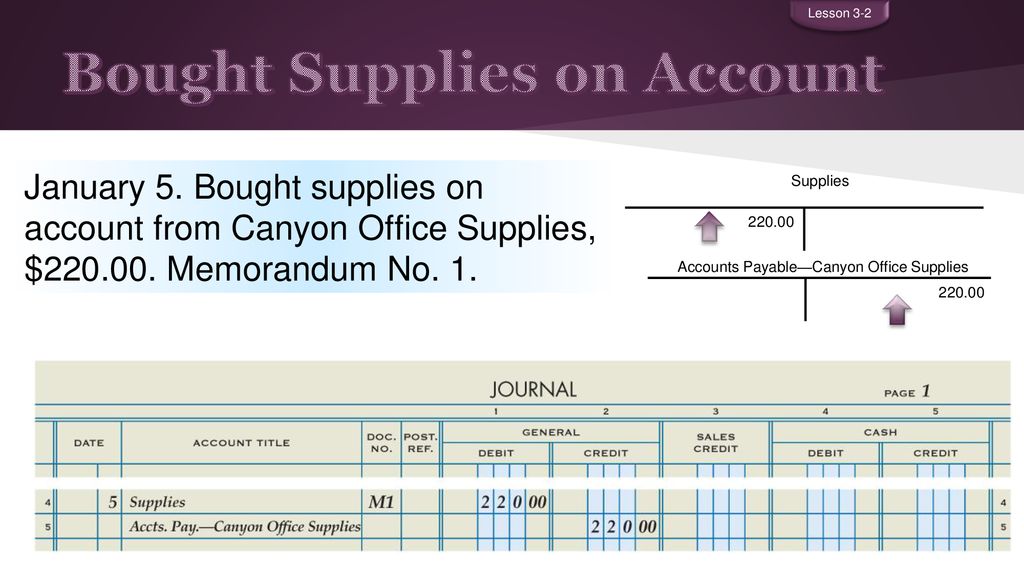

Debit Supplies and credit Cash. Solution On 1 st July 2019 when the goods were purchased on credit from the vendor then the purchases account will be debited in the books of accounts with the amount of such purchase and the corresponding credit will be. Journal entries are the way we capture the activity of our business.

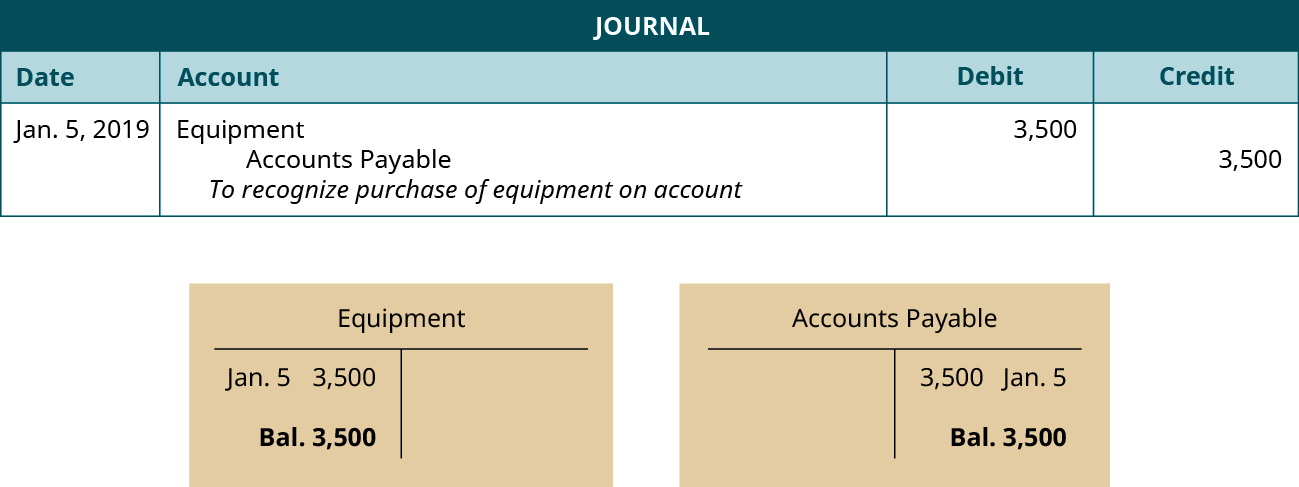

Purchased Equipment on Account Journal Entry. Q1 The entity purchased new equipment and paid 150000 in cash. Journal entries are also helpful in organizing accounts payable accounts receivable and expenses in connection with inventory.

Accounts Payable Supply Company 165000. Journal Entry for Credit Purchase and Cash Purchase. They include the computer vehicle machinery and so on.

Accounts Payable Supply Company 20000. Also charging supplies to expense allows for the avoidance of the fees. Debit Account PayableJones Supply Company and credit Supplies D.

The correct journal entry for the transaction BOUGHT SUPPLIES ON ACCOUNT FROM STEINMAN COMPANY is. What is the correct journal entry for the transaction BOUGHT SUPPLIES ON ACCOUNT FROM JONES SUPPLY COMPANY 250. Only later did the company record them as expenses when they are used.

Which Journal entry records the payment on account of those office supplies. Accounts Payable Supply Company 185000. Equipment is the assets that company purchase for internal use with the purpose to support business activities.

You can use this to keep track of money spent and money received. What journal entry will pass in the books of accounts to record the purchase of goods on credit and payment of cash against the purchase of those goods. Debit Supplies and credit Accounts PayableJones Supply Company C.

Answer choices debit Accounts PayableSteinman Company and credit Cash. In the journal entry Cash has a debit of 20000. Computers cars and copy machines are just some of the must-have company assets you use.

When merchandise purchased for cash is returned it is necessary to make two journal entries. Accounting for assets like equipment is relatively easy when you first buy the item. Thus consuming supplies converts the supplies asset into an expense.

Accounting Your business purchased office supplies of 2500 on account. When its time to buy new equipment know how to account for it in your books with a purchase of equipment journal entry. On January 3 2019 issues 20000 shares of common stock for cash.

Common Stock has a credit balance of 20000. First to record the purchase of supplies on credit. The journal entry to record this transaction is as follows.

For example on March 18 2021 the company ABC purchases 1000 of office supplies by paying with cash immediately. A Calculate the LCNRV using the individual-item approachb Prepare the journal entries as at 31 December 2020 assuming that a loss method and the Allowance to Reduce Inventory to NRV Account is used to record the write down of the inventoryc Assume that as at 31 December 2020 the account of Allowance to Reduce Inventory to NRV had a credit balance of RM14500. The journal entry is given below.

Date Accounts and Explanation. Accounting and journal entry for credit purchase includes 2 accounts Creditor and Purchase. Purchasing new equipment can be a major decision for a company.

Journal Entry DebitCredit Equipment 150000 n. In accounting the company usually records the office supplies bought in as the asset as they are not being used yet. In case of a journal entry for cash purchase Cash account and.

Debit Accounts PayableJones Supply Company and credit Cash B. They are not for resale. A journal entry is when you make a record of a transaction that happens in connection with your personal or business accounts.

At the end of the accounting period the cost of the supplies used during the period is computed and an adjusting entry is made to record the supplies expense. Office supplies used journal entry Overview. Likewise the office supplies used journal entry is usually made at the period end adjusting entry.

Adjusting Entry at the End of Accounting Period. For example suppose a business purchases supplies such as paper towels cleaning products and other consumables for a total amount of 50 and pays for the items with cash. Prepare a journal entry to record this transaction.

How is a journal entry for purchase returns different from a journal entry for a return of merchandise purchased for cash. Third to record the cash payment on the credit purchase of supplies. Accounting questions and answers.

Second to record the return of supplies. Assume the purchase occurred in a prior period Date Accounts and Explanation Debit Credit ОА. The purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry.

Sedlor Properties purchased office supplies on account for 800.

Business Events Transaction Journal Entry Format My Accounting Course

Purchase Office Supplies On Account Double Entry Bookkeeping

Paid Cash For Supplies Double Entry Bookkeeping

Unit 5 The General Journal Journalizing The Recording Process Ppt Download

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Chapter Journal Review Ppt Download

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

0 comments

Post a Comment